You will see the ‘Online Services’ tab appear on the left hand side of the website. All you have to do is visit the FBR’s website.

It is quite simple to get the online NTN verification in Pakistan. HOW IS ONLINE NTN VERIFICATION DONE IN PAKISTAN? the Tax Asaan App, so that you can check the online NTN verification while on the go. Also, there are two ways through which you can verify your National Tax Number (NTN) – either through the Federal Board of Revenue’s (FBR) website or through FBR’s official mobile application i.e. We will go step by step and help you through the process of verifying your tax number online. If you are wondering how to check online NTN verification in Pakistan, then this blog is for you.

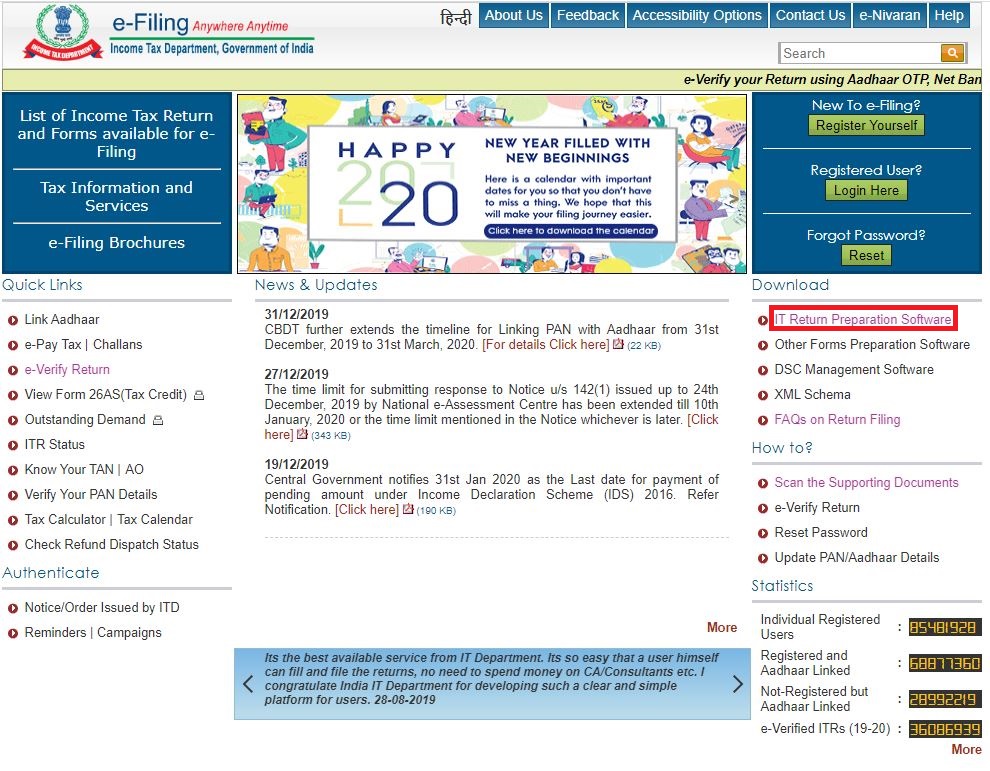

The authority has also updated its Tax Asaan application to make it easier for the citizens to file their wealth statement and carry out their online NTN verification. So, if you haven’t filed your taxes yet, make sure to log in to the FBR’s IRIS portal to complete the process. The Federal Board of Revenue (FBR) has announced December 08, 2020, as the last date for filing income tax returns for the fiscal year 2019-2020. However, it has authorized respective chief commissions to accept the requests for extension after the deadline. In addition to that, the FBR has ruled out a further extension in the filing of income tax returns. The overseas Pakistanis who wish to avail income tax exemption on ‘profit on debt’ received from the remittances deposited in their domestic bank accounts will now have to submit ‘exemption certificates’ to their respective banks, according to a report published in a leading English newspaper.

0 kommentar(er)

0 kommentar(er)